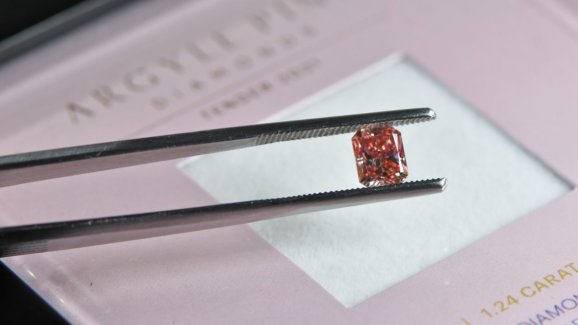

Diamonds are undoubtedly the oldest, hardest and, in the long term, the most stable investment on the market. Diamonds are also known as “the currency of the Jews”.

WHY DOESN'T MY BANK OFFER ME AN INVESTMENT IN DIAMONDS?

FOR THIS REASON: IT CAN'T!

Banks are only interested in retaining as much capital as possible. They naturally give their own investment products the advantage in sales and marketing.

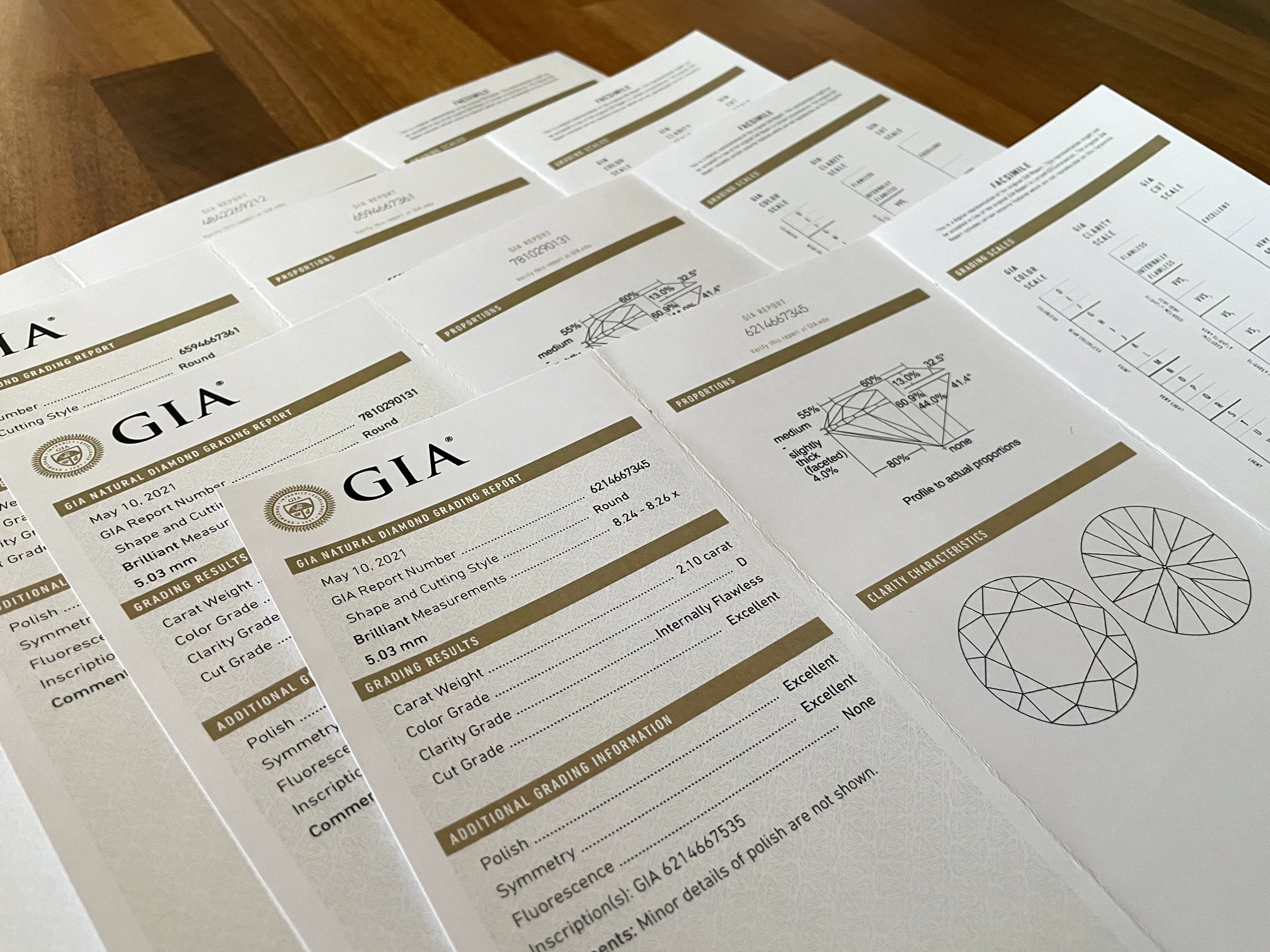

Investing in “very very rare” diamonds enables continuous growth in value over the long term. Diamonds are therefore not suitable for speculators. Naturally, the investor receives Swiss custody account management from our company in order to meet individual needs.